The New Gilded Age of Health Tech: Market Timing, AI, and the Illusion of Innovation

Perspective from a Decade in the Trenches

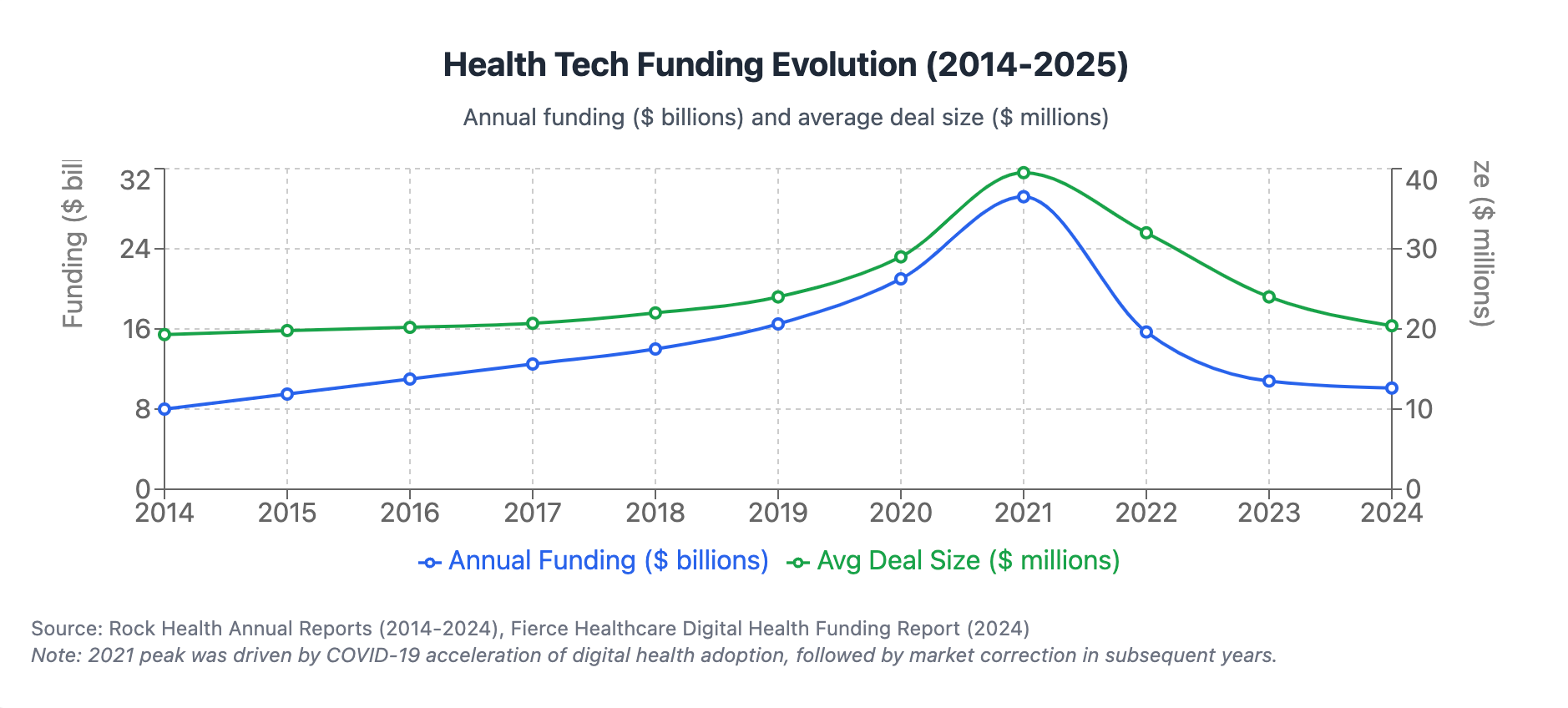

Having built health tech companies since 2015, I've watched the industry's evolution with both amusement and fascination. To those of us who've operated in this space for the past decade, it's difficult to be shocked or surprised by what today's companies label as "innovation." The ability to collect vast amounts of biomarker data, analyze it, and discover insights has been the foundation of scientific wellness for years. What's changed isn't the core approach but rather the economics and accessibility of the tools.

What Arivale was doing in 2015 at $3,500 per year, companies like Superpower and Function Health are now offering at a fraction of the cost. The science hasn't fundamentally changed – but the business opportunity certainly has.

The Economics Revolution in Health Monitoring

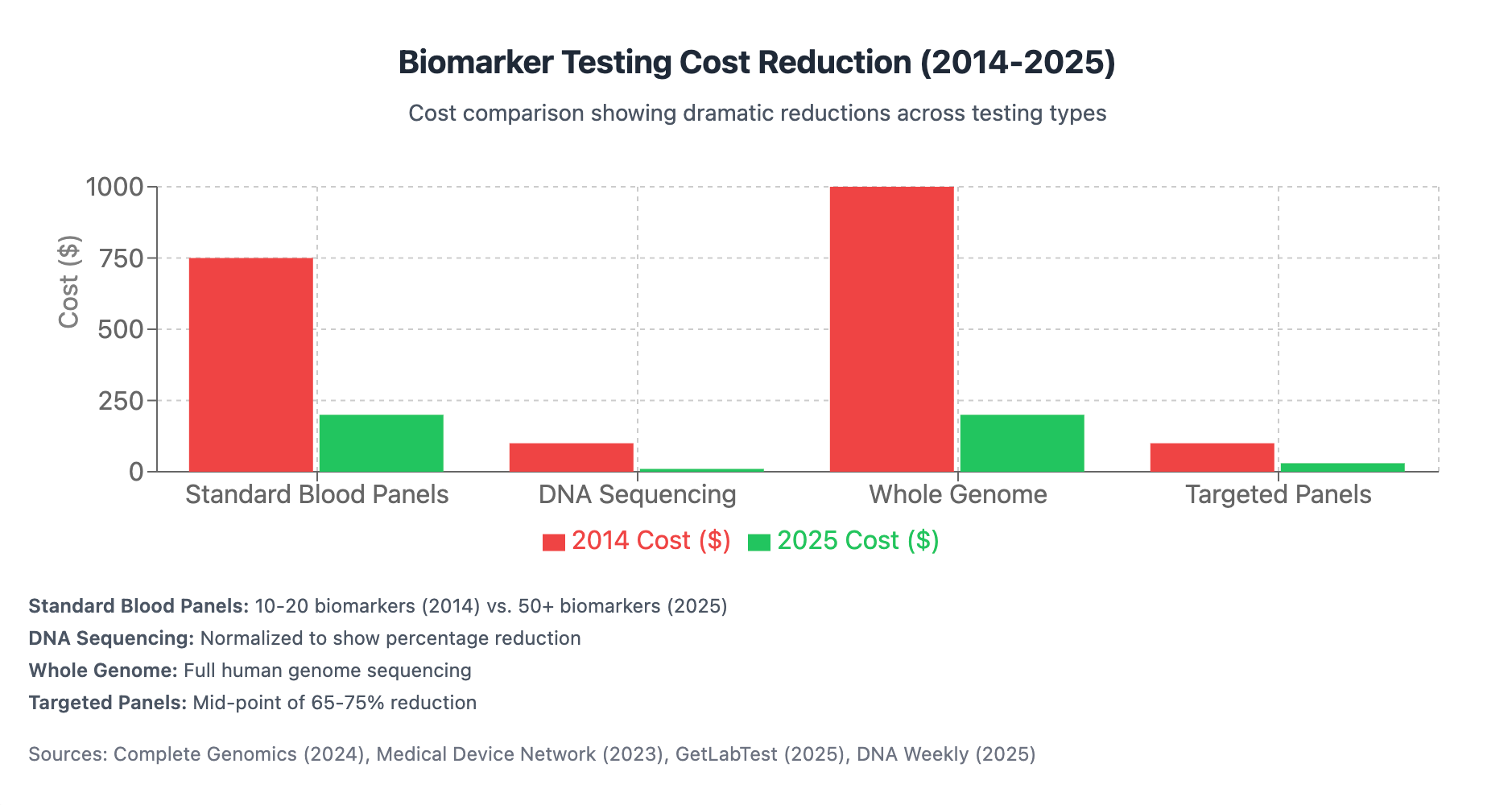

When we started building comprehensive health monitoring platforms, the obstacles were primarily economic. Blood-based biomarker collection was prohibitively expensive, requiring either insurance coverage or significant out-of-pocket expenses. The testing itself was inordinately costly, relegating comprehensive biomarker panels to research settings rather than commercial applications.

Fast forward to 2025, and the landscape has transformed dramatically. Quest Diagnostics and LabCorp have scaled their operations and slashed costs. What once cost $500-1,000 for 10-20 biomarkers now delivers 50+ biomarkers for $100-300. Targeted biomarker panels have seen cost reductions of 65-75%, while next-generation genome sequencing has dropped by 80% in the past decade.

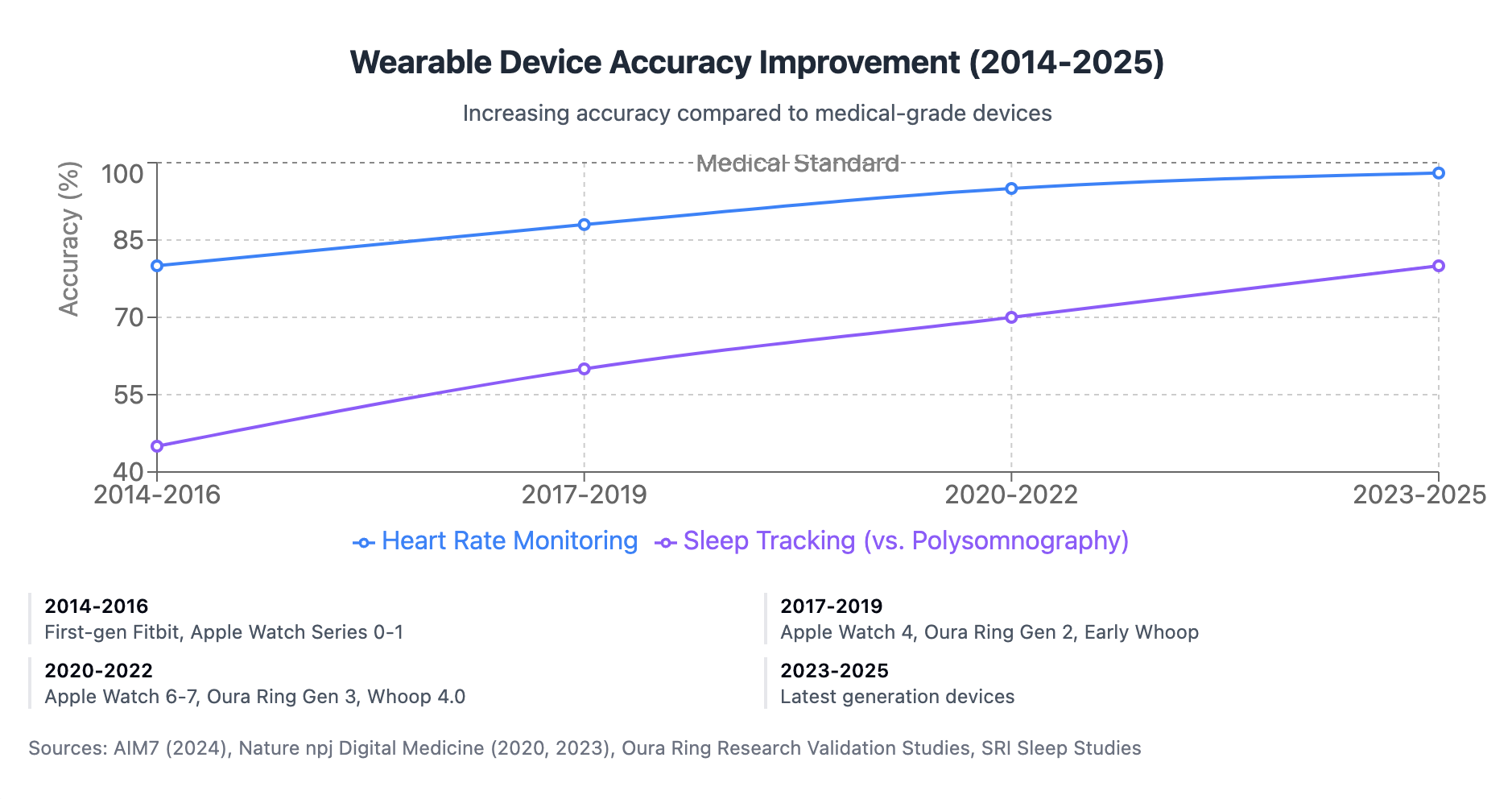

Similarly, digital biomarkers have been democratized through consumer wearables. Companies like Whoop, Oura, Garmin, and Apple have made continuous monitoring of heart rate variability, sleep quality, respiratory rate, and other crucial metrics accessible to the average consumer. The accuracy of these devices has improved from 15-20% below medical standards to within 1-3% for many key metrics.

Medical imaging has followed suit, with portable, smartphone-connected ultrasound devices entering the market and MRI scan times reduced by 30-60%. The components for creating a comprehensive "digital twin" – once a purely theoretical concept – are now commercially available and increasingly affordable.

The AI Multiplier Effect

The second major shift has been in data analysis. In 2018, extracting insights from user data required building extensive data science teams – a process that was labor-intensive, expensive, and slow. The data from wearables and sensors was highly variable, making analysis even more challenging.

Today, large language models and specialized AI tools are available via API, effectively outsourcing the hardest parts of the analysis. What previously required a team of five developers working for six months can now be accomplished in a few hours. Pre-trained AI models have drastically reduced the need for companies to build capabilities from scratch, while modern development frameworks and API ecosystems have accelerated development timelines.

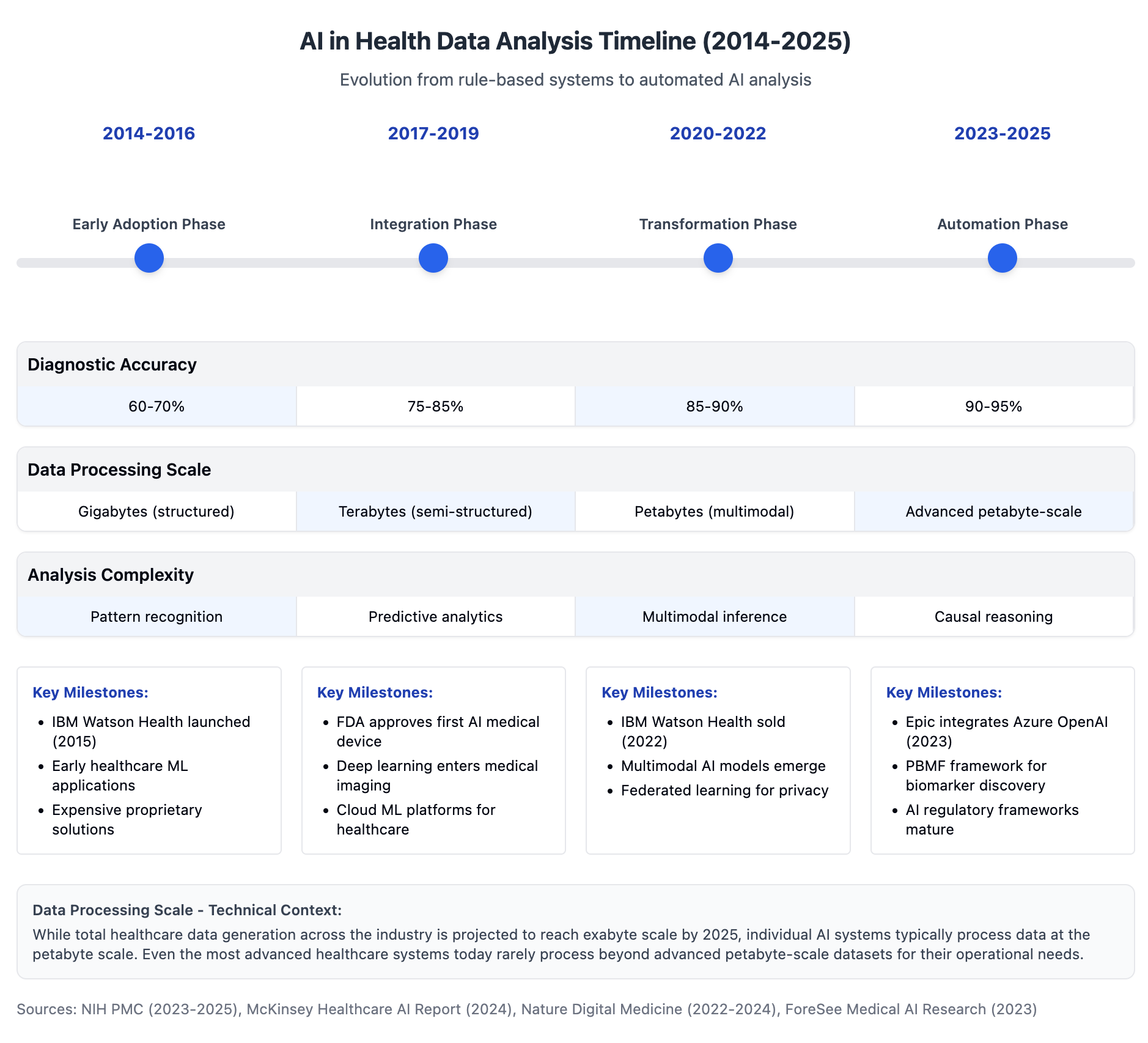

AI capabilities in health data have evolved remarkably. Diagnostic accuracy has increased from 60-70% in 2015 to 90-95% by 2025, with some systems exceeding expert-level performance. Processing power has scaled from handling gigabytes of structured data to analyzing petabytes of multimodal healthcare data in near real-time.

The Perfect Storm: Low-Cost Biomarkers Meet AI Analysis

We've now reached a confluence where low-cost, broad-spectrum biomarkers can be paired with powerful AI analysis. The insights that companies like Arivale pioneered a decade ago can now be generated at a fraction of the cost.

This creates an entirely new opportunity. One can legitimately build a health tech company by outsourcing the majority of the work, with partners helping collect blood samples (Quest Diagnostics, Tasso), tools analyzing the datasets, and platforms building HIPAA-compliant infrastructure.

The most ambitious companies are now creating comprehensive digital twins, incorporating blood biomarkers, wearable data, imaging, and other sources to build complete baselines for users. We're seeing this from Whoop (expanding into blood testing), Function Health (also expanding into imaging), and Superpower (building comprehensive digital twin stacks with AI analysis).

The Scientific Perspective vs. The Business Opportunity

From a scientific lens, it's difficult to call much of what's happening today truly "wondrous" or innovative. The basic building blocks have been around for years – they've just gotten easier and cheaper to implement.

But from a business opportunity standpoint, it's an entirely different ballgame. The costs to collect biomarkers, analyze data, and deliver interventions have never been lower. Companies that build engaging user experiences with clear messaging and effective customer acquisition strategies have unprecedented opportunities to succeed.

The best parallel might be the original Gilded Age, when industrialists didn't necessarily invent new technologies but rather found ways to scale and commercialize existing innovations. We appear to be in a new Gilded Age of health tech – where the winners won't necessarily be the scientific pioneers but those who can package the technology most effectively.

The Insurance Chasm: From Wellness to Healthcare

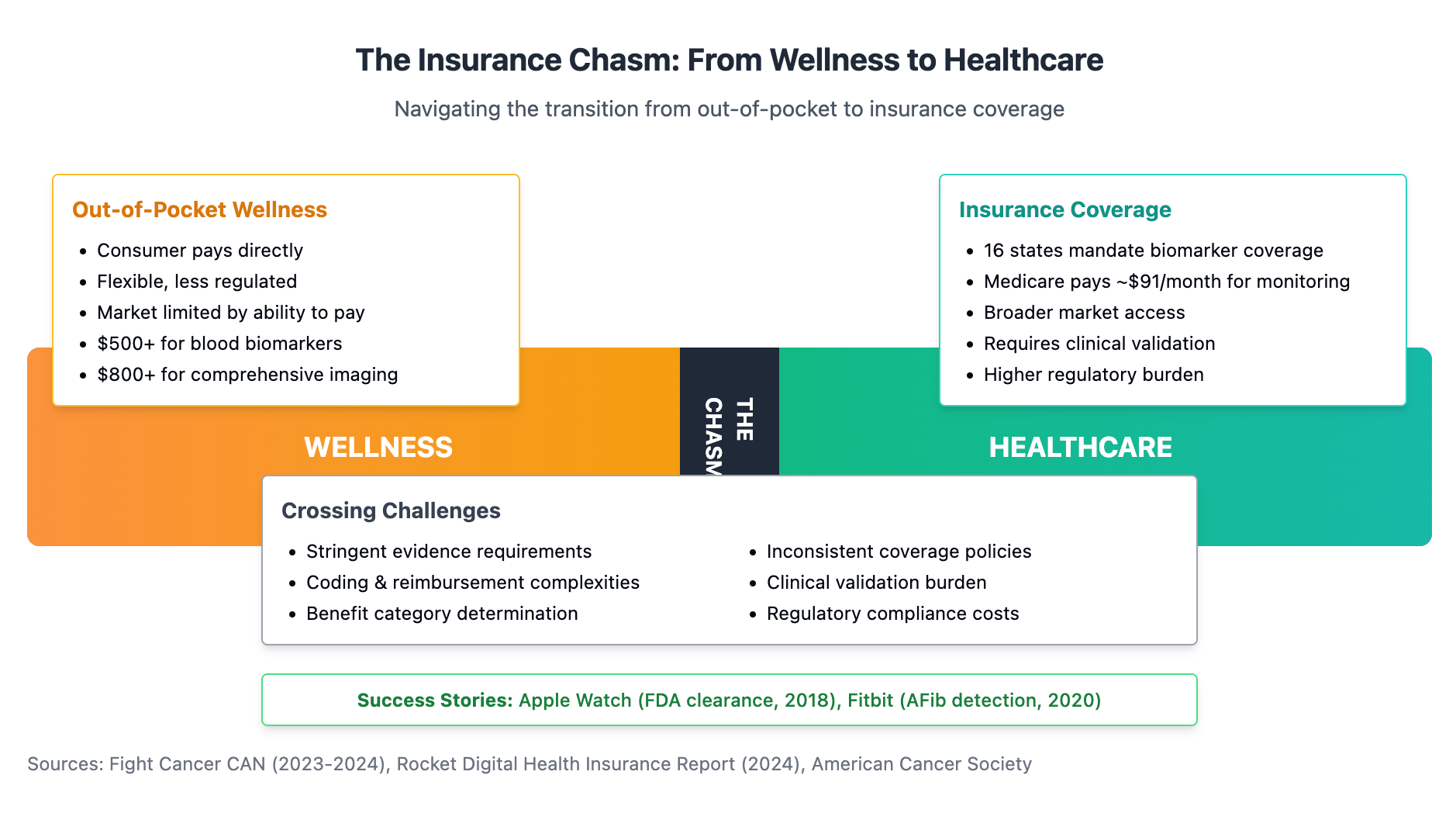

There remains a significant challenge: most comprehensive health monitoring and digital twin technology remains primarily out-of-pocket. A sufficient baseline test still costs over $500 for blood-based biomarkers alone, plus another $800+ for comprehensive imaging, not to mention the ongoing cost of interventions.

The companies that will ultimately dominate this space will be those that successfully cross the chasm from wellness to healthcare by forging partnerships with insurance providers. Function Health, for instance, may face challenges by remaining exclusively out-of-pocket, requiring customers to switch to traditional medical care when they actually get sick.

By contrast, companies that build strong consumer traction and then present their AI capabilities to insurers will have a monumental opportunity to integrate into the broader healthcare ecosystem. The path from out-of-pocket wellness to insurance-covered healthcare is arduous, but it's the trajectory that will ultimately yield the most significant success.

The Data Portability Paradox: A Warning for Investors

It's crucial for investors to recognize that while technological barriers are falling, healthcare remains difficult, highly political, and filled with legal pitfalls that can sink an otherwise promising company. As more tech and software-oriented founders enter healthcare for the first time, they'll face a tough reality that few are prepared for.

One particularly thorny issue centers on data ownership. In healthcare, as in most software sectors, consumers have a right to their data – and this creates a significant vulnerability for companies whose primary value proposition is data collection and analysis.

Consider the fundamental business model: consumers use these platforms to develop large repositories of their own health information. After paying for comprehensive testing and monitoring, users can legally export their entire dataset to a competitor with a superior AI model or better intervention offerings. For companies leveraging third-party AI tools rather than proprietary analytics, this represents an existential threat.

If a company's value is primarily derived from collecting data and applying a licensed AI model (which they must subsidize the cost to use) to deliver insights back to customers, they lack a defensible moat. When the next competitor arrives with marginally better technology or marketing, what prevents customer exodus?

This reality points to two clear paths to sustainable financial success:

- Insurance Integration: Securing reimbursement pathways that lock in recurring revenue streams regardless of the latest consumer trends.

- Proprietary Interventions: Developing unique, effective interventions that users can only access through ongoing engagement with the platform.

Companies without a clear strategy for one or both of these approaches may find themselves in a precarious position – having invested heavily in customer acquisition only to watch those customers migrate their data to the next entrant with minimal switching costs.

Where To Place Your Bets

For investors and entrepreneurs looking at this space, several key opportunities stand out:

- Unified Experience Platforms with Defensible Moats: Companies building brandable, user-friendly experiences where comprehensive data can be analyzed securely, but that also have clear strategies for customer retention beyond data collection alone.

- Novel Biomarker Development: As existing biomarkers become commoditized, those developing new markers that provide unique insights will create differentiated value.

- Cost Reduction Technologies: Despite dramatic improvements, further reducing the cost of biomarker collection remains a significant opportunity.

- Proprietary AI Analysis Capabilities: Companies developing their own AI capabilities rather than relying exclusively on third-party models will have stronger defensibility as data portability increases.

- Effective Interventions: Ultimately, when data collection and AI analysis become ubiquitous, the differentiator will be access to the most effective interventions that move the needle on health outcomes.

The New Model of Health Innovation

Traditional health innovation followed a predictable path: identify a biomarker indicating a specific outcome, develop a product to move that marker in the right direction, and build a business around that intervention. This model was expensive and time-consuming, requiring extensive data collection before making claims.

The emerging model takes a more exploratory approach: collect as much data as possible, apply AI to identify novel correlations, and iterate rapidly based on those insights. This "shotgun approach" would have been prohibitively expensive even five years ago, requiring millions in data science salaries. Today, it's accessible to startups with modest funding.

Companies like Function Health and Superpower can now build waitlists of 100,000+ customers in less than a year, convert them to provide comprehensive biomarker data, and use AI to analyze patterns and recommend interventions. The insights generated from this approach – particularly when measuring intervention impacts at a population level – could revolutionize preventative healthcare.

Navigating Healthcare's Complexities for Tech Founders

As this new wave of health tech accelerates, it's worth emphasizing that success will depend more on tech-savvy implementation than healthcare expertise to achieve widespread adoption. However, tech founders entering healthcare for the first time should approach with caution. Healthcare is not merely another vertical to disrupt – it comes with entrenched systems, powerful stakeholders, and regulatory frameworks that have ended many promising startups.

Beyond the data portability challenges mentioned above, healthcare remains stubbornly resistant to the "move fast and break things" ethos that works in other sectors. Founders must balance innovation with compliance, user experience with clinical validity, and growth with sustainability.

The companies most likely to succeed will be those that pair tech-industry agility with healthcare-industry patience. They'll need to navigate FDA requirements without making unsubstantiated medical claims, respect patient privacy while leveraging data for insights, and develop clinically meaningful interventions rather than mere lifestyle optimizations.

Conclusion: Market Timing Is Everything

While scientists and academics may look askance at today's health tech landscape, seeing more repackaging than true innovation, the reality is that market timing often matters more than scientific novelty. The confluence of affordable biomarker collection, powerful AI analysis, and growing consumer interest in proactive health management has created an unprecedented opportunity.

For founders who have operated in health tech during the first quarter of this century, the costs today are staggeringly low compared to just five years ago. What once required six months and a team of developers can now be built in hours. We are indeed in a new Gilded Age of health tech – where the opportunities for building profitable, impactful companies have never been greater.

The question isn't whether these companies are doing something scientifically groundbreaking – most aren't. The question is whether they can leverage existing technologies at the right time, with the right user experience, to build businesses that ultimately transform healthcare. And whether they can establish defensible business models that survive the inevitable transition from novelty to commodity.

For those who navigate these complexities successfully, the rewards will be extraordinary – not just financially, but in advancing a new paradigm of preventative, personalized healthcare that genuinely improves human healthspan. And in that regard, the race is very much on.