The Longevity Convergence

How Private Capital, Self-Experimentation, and Combinatorial Medicine Could Accidentally Solve the Innovation Problem in Human Longevity

I. The Core Insight

In longevity medicine, the funder, the research subject, and the intended beneficiary can be the same person. This is unusual. In oncology, the philanthropist funding cancer research is rarely the patient. In infectious disease, the Gates Foundation is not vaccinating Bill Gates. But in longevity, the billionaire writing the check to the senolytic biotech company is also the person who wants to take the senolytic. The investor backing the peptide platform is also the patient asking their concierge physician about that same peptide.

This collapse of roles creates a structural opportunity that no other category of medicine offers. When the person funding the science is also the person consuming the science, two activities that normally operate in separate institutional silos (capital allocation and clinical care) can be connected into a single system. The investment generates clinical insight. The clinical data sharpens the investment thesis. The patient gets better medicine. The fund gets better returns. And the data generated by the whole cycle, if properly structured, becomes a public good.

That system does not yet exist. This paper describes its architecture.

II. The Broken Pipeline

There is a $27 trillion market forming around the basic human desire to not die, and the infrastructure to capture it doesn't exist yet.

The science is not the bottleneck. Senolytics are clearing senescent cells in clinical trials. GLP-1 receptor agonists have rewritten metabolic medicine. Epigenetic reprogramming is demonstrating age reversal in mammalian tissue. NAD+ precursors are restoring mitochondrial function. AI-driven drug discovery is compressing timelines from decades to months.

The demand is not the bottleneck. Approximately 290,000 ultra-high-net-worth individuals globally hold $30 million or more in investable assets, and a growing percentage spend $50,000 to $200,000 or more annually on longevity interventions: hormone optimization, IV therapies, advanced diagnostics, regenerative medicine, stem cell treatments, exosome therapy, peptide protocols, personalized supplement stacks.

The bottleneck is a structural mismatch between how longevity science works and how capital markets are designed to fund it.

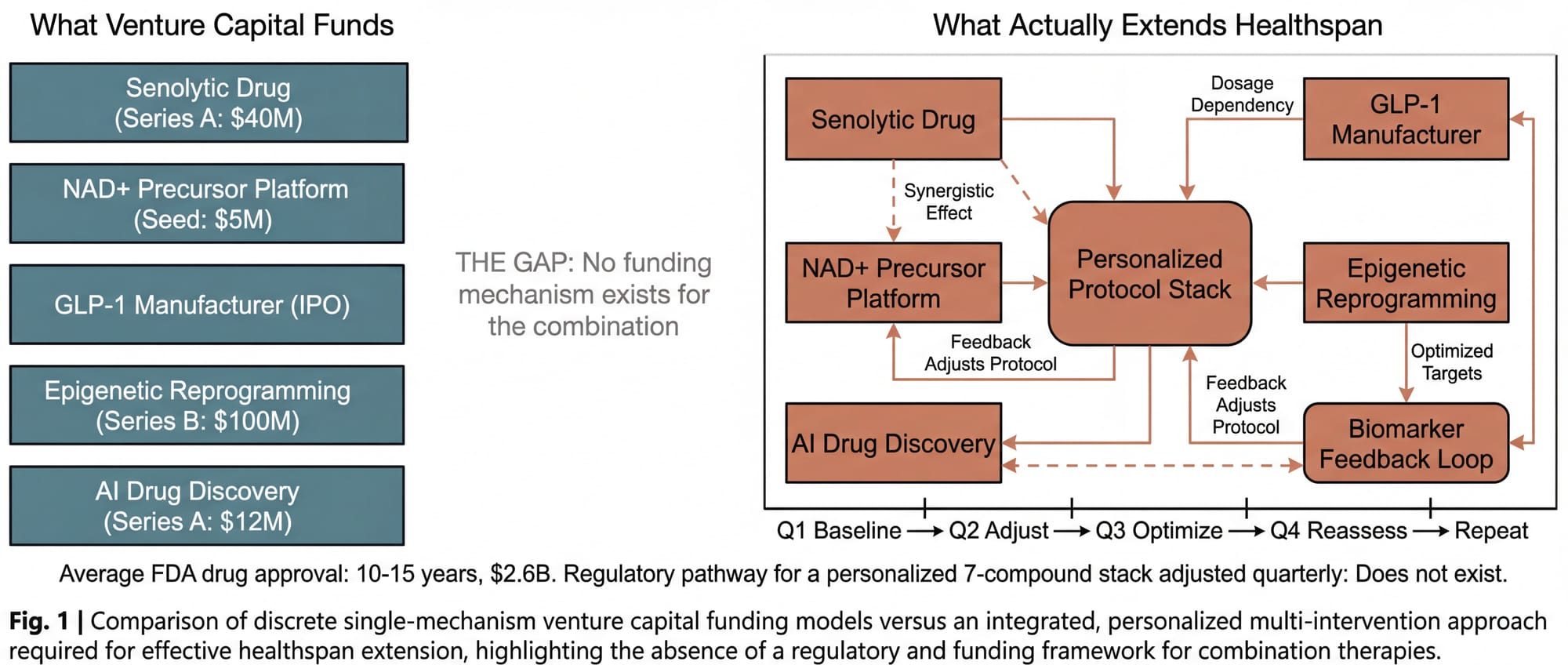

Venture capital is built for discrete bets. One drug. One mechanism. One target. A senolytic company can raise a Series A. An NAD+ precursor platform can raise a seed round. Each sits in a clean box with a defined regulatory pathway.

Longevity doesn't work that way. The clinical evidence points overwhelmingly in one direction: extending healthspan requires the orchestration of multiple simultaneous interventions. Not one drug. A protocol. A stack. Senolytics clearing the debris, NAD+ restoring energy production, peptides modulating inflammation, hormone optimization rebalancing signaling, epigenetic interventions resetting the clock. All titrated to individual biomarkers, adjusted quarterly, monitored longitudinally.

There is no equity position in a combinatorial longevity protocol. You can invest in the senolytic company. You can invest in the NAD+ company. You cannot invest in the intelligent combination of both, plus four other things, personalized to a specific patient's epigenetic profile and adjusted every ninety days. That isn't a company. It's a clinical practice. And clinical practices don't raise venture rounds.

The science that works (the combinatorial, personalized approach) has no natural funding mechanism. The science that gets funded (discrete, single-mechanism interventions) is, by itself, insufficient to move the needle on healthspan. The pipeline is broken not because the parts don't exist. It's broken because nobody has designed the system that connects them.

III. The Two-Tier System That Already Exists

Before going further, it is worth acknowledging something that most people in longevity medicine know but few say publicly: the two-tier system is already here. It has no official name, but it operates in every major metropolitan area in the United States.

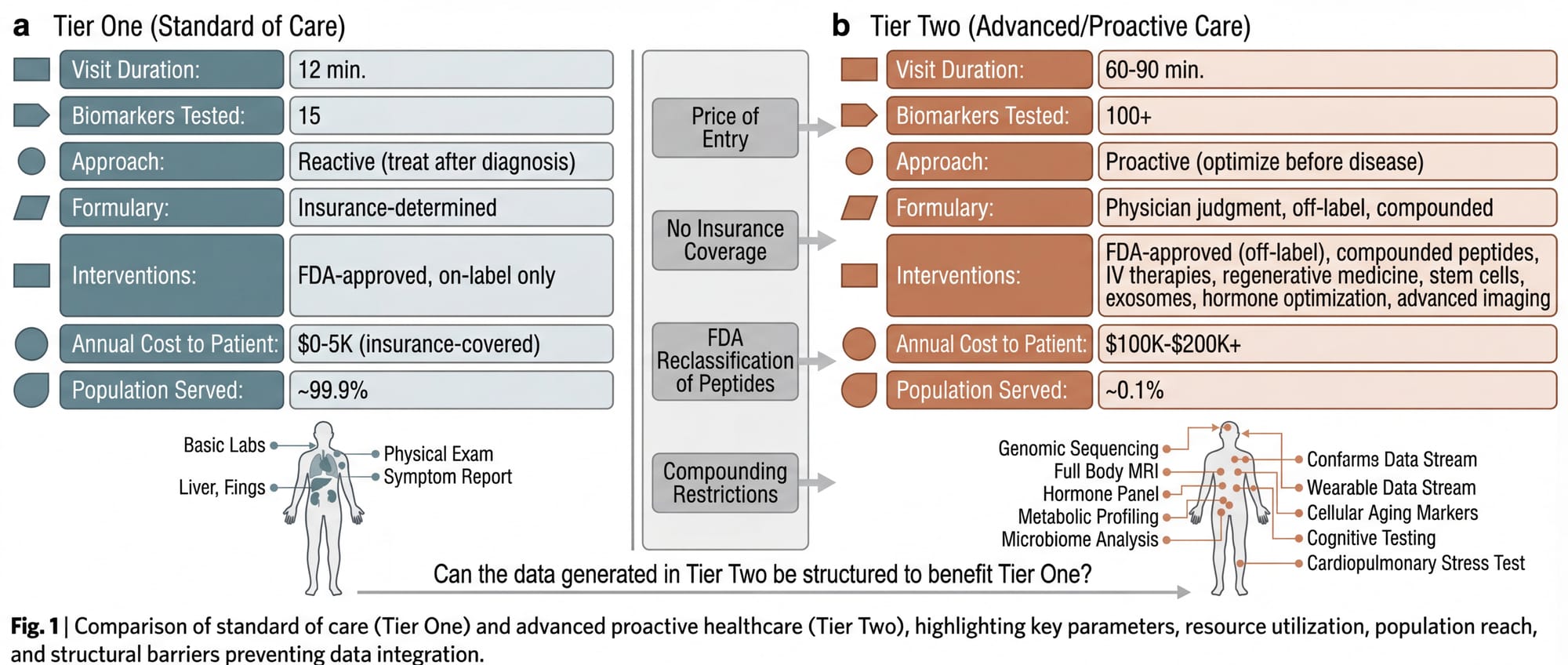

Tier One is the system most Americans experience. FDA-approved, insurance-reimbursed, guideline-driven. Reactive by design: you get sick, you get treated. Twelve minutes per appointment, a formulary determined by your insurance carrier, a standard of care defined by large-scale randomized controlled trials. This system is not designed to optimize health. It is designed to treat disease after it manifests.

Tier Two is the system approximately 0.1% of Americans experience. The concierge physician. The longevity clinic. Sixty to ninety minutes per visit. Bloodwork panels with 100+ biomarkers. FDA-approved drugs prescribed off-label based on emerging evidence (metformin for longevity, rapamycin for immune modulation, low-dose naltrexone for inflammation, GLP-1 agonists for metabolic optimization in non-diabetic patients). Compounded peptides, IV therapies, hormone optimization, stem cell treatments, exosome infusions, regenerative medicine, advanced diagnostics that insurance doesn't cover and most primary care physicians don't order.

None of this is illegal. Off-label prescribing is a cornerstone of American medicine. Compounded medications from licensed pharmacies are legal. The physician's clinical judgment is the governing authority, not the FDA formulary. But the price of entry is steep: a comprehensive longevity program with physician oversight, advanced diagnostics, and a meaningful intervention stack runs $100,000 to $200,000+ annually once stem cell therapies, exosome treatments, and regenerative protocols are included.

The result is a healthcare system that functions like the financial system: those with capital get access to better instruments, better information, and better outcomes. The gap is widening every quarter as the science accelerates faster than the regulatory apparatus can approve it. The FDA is reclassifying peptides, restricting compounding, and tightening access to the substances Tier Two physicians use to produce results that Tier One physicians cannot replicate.

This is not a conspiracy. It is an incentive structure. The FDA's mandate is to protect the public from unsafe drugs. That mandate was designed for a world where a single pharmaceutical company sells a single drug to millions of patients. It was not designed for a world where a concierge physician designs a personalized seven-compound protocol for a single patient, adjusts it quarterly based on bloodwork, and monitors outcomes in real time. There is no regulatory pathway for that. So it exists in a space that is legal, ethical, evidence-informed, and completely invisible to the system that governs American medicine.

The question is not whether the two-tier system should exist. It exists. The question is whether the data, protocols, and outcomes generated in Tier Two can be structured to benefit Tier One. Whether the private can inform the public.

IV. The Pattern: Private Self-Interest as Public Funding Mechanism

The idea that private self-interest can produce public goods is not new. It is the foundational premise of market economics. In longevity medicine, the mechanism is unusually direct.

Bryan Johnson spends over $2 million annually on self-experimentation and has published more self-reported, multi-intervention longevity protocol data than any individual in history. The scientific rigor is limited (n=1, no controls, no peer review), but the transparency is unprecedented: protocols, biomarker trajectories, and failure reports are publicly documented. Practitioners globally reference and adapt his data. Peter Attia's concierge practice generates clinical outcomes data that informs his public education reaching millions. Jeff Bezos committed $3 billion to Altos Labs. Peter Thiel has funded the Methuselah Foundation and Breakout Labs. Larry Ellison has directed over $430 million to anti-aging research. Sovereign wealth funds in Saudi Arabia, Singapore, and the UAE are building longevity-focused investment vehicles.

The motivations are complicated and consistently self-interested. The output is unambiguous: billions in private capital flowing to longevity science, all producing research, data, and therapeutic development that (when published, licensed, or eventually approved) benefits people who will never write a $3 billion check.

But the pattern is chaotic. Johnson publishes because he chooses to. Attia teaches because it builds his brand. Bezos funds Altos Labs because he can afford to. There is no system that converts private longevity investment into public longevity benefit reliably, repeatedly, and at scale.

The question is whether such a system can be designed.

V. The Architecture of Convergence

A concept was fully architected, legally structured, and financially modeled for an entity that would attempt exactly this conversion. It was designed for California. It was never built.

What follows is the architecture. Not as a pitch (there is no fund being raised, no membership being offered, no entity currently operating) but as a structural proof of concept. A demonstration that the convergence is not just theoretically desirable but practically buildable.

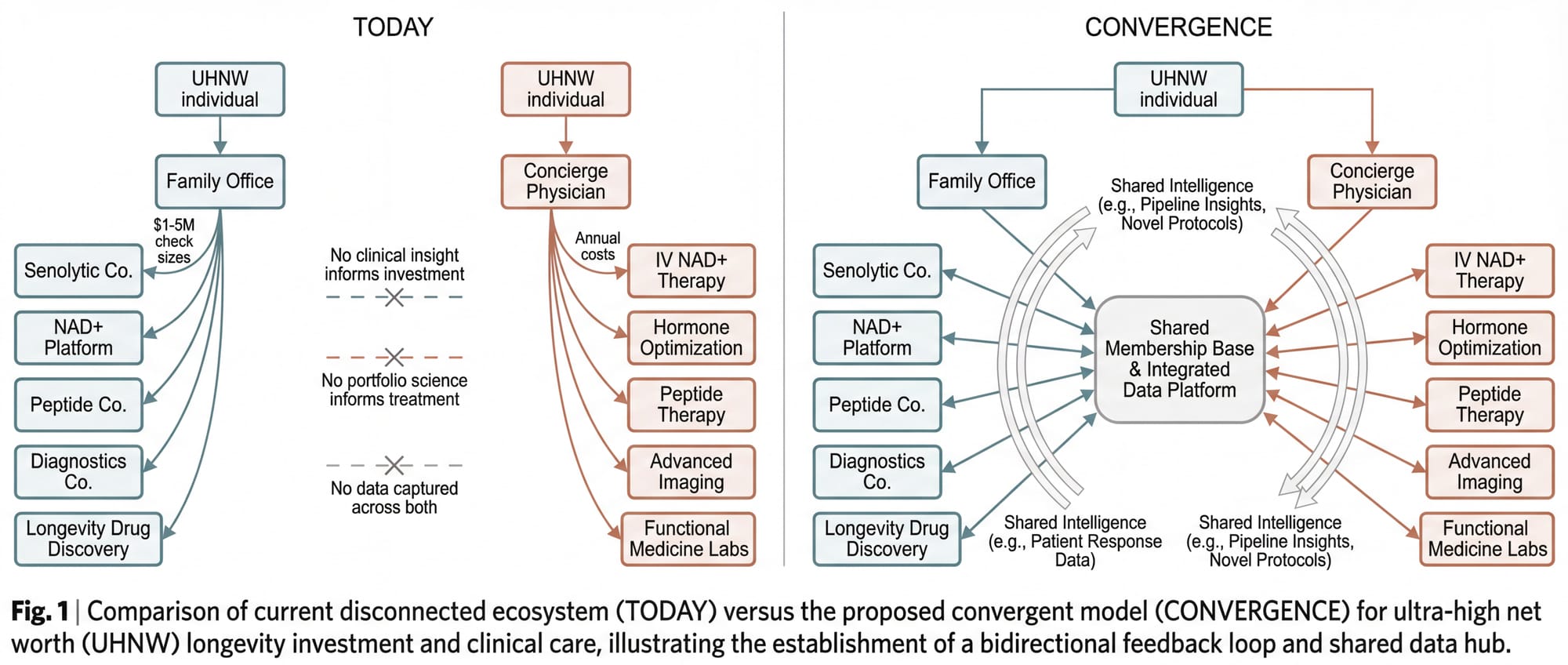

The concept rests on a simple observation: the people with the capital to fund longevity companies are the same people spending a fortune on longevity treatments, and these two activities have never been connected.

An ultra-high-net-worth individual might invest $2 million into a senolytic biotech company through their family office on Monday, and on Thursday receive an IV NAD+ infusion from a concierge physician who has no idea what's in that investor's portfolio. The investment generates no clinical insight. The clinical data generates no investment insight. The capital and the care exist in parallel universes.

The convergence model connects them.

The Fund

A $75 to $100 million venture fund (Fund I), structured as a Delaware Limited Partnership under SEC Regulation D, Rule 506(c). Accredited investors only. Standard 2-and-20 fee structure with an 8% preferred return. Investment focus: concept stage through Series B longevity, healthspan, and biotech companies, with concentration in pre-seed to Series A. Target portfolio: 20 to 30 companies across therapeutics, diagnostics, digital health, medical devices, and AI-driven drug discovery.

The stage breadth matters. At concept and pre-seed, the clinical practice identifies unmet needs and emerging intervention gaps before companies form around them. At seed and Series A (the core allocation), the fund's clinical validation edge is sharpest: real-world patient data testing early-stage claims. At Series B and growth, the practice's longitudinal dataset (multi-year, multi-intervention, multi-biomarker) provides differentiated diligence that pure financial investors cannot replicate. A fund of this size can lead or co-lead rounds in the $5 to $15 million range, participate meaningfully in larger syndicated rounds, and reserve sufficient capital for follow-on investment to protect positions as portfolio companies mature.

The fund's edge is not financial engineering. The edge is clinical validation. When the fund is paired with an operating clinical practice, the diligence process includes something no other longevity fund can offer: real-world testing. A biotech company claims its senolytic compound clears 40% of senescent cells? The clinical practice can evaluate that claim against its own patient data. A diagnostics platform claims its biomarker panel predicts cardiovascular risk with 95% accuracy? The practice can test it. The fund doesn't just invest in science. It practices the science and knows, from direct experience, what works.

Fund II ($150 to $200 million) is contingent on Fund I performance and the maturation of the clinical dataset. By the time Fund II deploys, the practice will have generated three to five years of longitudinal outcomes data, making the clinical validation edge not just a thesis but a demonstrated capability.

The Practice

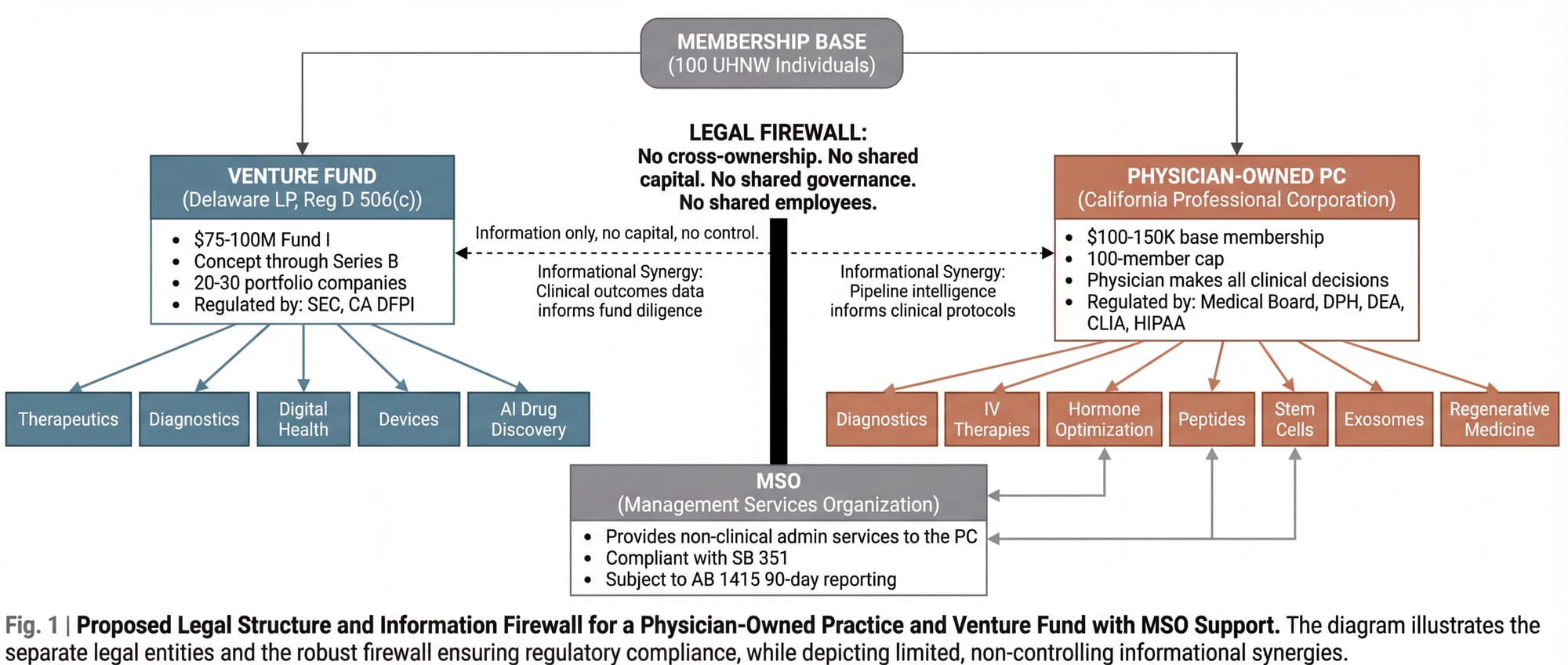

A physician-owned Professional Corporation (the only legal structure permitted under California's Corporate Practice of Medicine doctrine). The physician-owner makes all clinical decisions, hires all clinical staff, owns all patient relationships, and controls all medical records. No investor, fund manager, or non-physician has any ownership interest in or operational control over the clinical entity. This is not a preference. It is the law, significantly strengthened in 2026 by SB 351, which explicitly prohibits private equity and hedge fund interference in clinical operations.

The practice operates as a membership-based longevity clinic. 100-member cap. Annual base memberships of $100,000 to $150,000. Services included in the base membership: comprehensive quarterly diagnostics (100+ biomarker panels, genetic and epigenetic profiling, continuous glucose monitoring), full-body MRI through imaging center partnerships, DEXA and VO2 max testing, personalized longevity protocol design, IV therapies (NAD+, micronutrient, glutathione), hormone optimization, peptide therapy, care coordination, and dedicated physician access (60 to 90 minutes per visit, quarterly minimum, with on-call availability).

Advanced regenerative interventions (stem cell therapy, exosome infusions, PRP treatments, gene therapy protocols as they become available) are billed at cost-plus above the base membership, reflecting the significant per-treatment expense of these therapies. A single stem cell treatment ranges from $5,000 to $50,000 depending on source and application. Exosome therapy runs $3,500 to $15,000 per treatment cycle. A member on a comprehensive regenerative protocol may spend $200,000 or more annually. This tiered structure keeps the base membership accessible within the UHNW target population while honestly reflecting the cost of delivering advanced interventions.

For context: Equinox's Optimize program charges $40,000 per year for personal training, nutrition coaching, sleep coaching, and biomarker testing through Function Health. It includes no physician, no prescribing authority, no IV therapies, no regenerative medicine, and no advanced imaging. The convergence practice delivers a fundamentally different (and more expensive) category of care. Pricing it below a gym program, regardless of how premium that gym is, would misrepresent the service and undermine the economics.

The practice is not a research institution. It is a clinical operation. But it generates, as a natural byproduct of serving its members, a dataset of extraordinary value: longitudinal, multi-intervention, multi-biomarker outcomes data on a population of high-compliance patients receiving the most advanced longevity protocols available. That dataset is the raw material for research that no academic institution is positioned to conduct, because no academic institution has a patient population willing to invest $100,000+ a year for this level of care and monitoring.

The Firewall

The fund and the practice are legally, financially, and operationally separate entities. The fund does not invest in the practice. The practice does not use fund capital. They share no bank accounts, no governance structures, no employees. The connection runs through the founding leadership and through the membership base: individuals who may choose to participate in both the fund and the practice independently.

A Management Services Organization (a third entity) provides non-clinical administrative services to the practice under a Management Services Agreement, structured in compliance with SB 351 and subject to 90-day advance reporting to the California Office of Health Care Affordability under AB 1415.

The structural complexity is not incidental. It is the barrier to entry. Anyone with capital can start a longevity fund. Anyone with a medical license can start a longevity clinic. Building both in parallel, in regulatory compliance, with the informational synergy intact and the legal firewall impregnable, requires architectural sophistication that deters casual imitation.

The Cycle

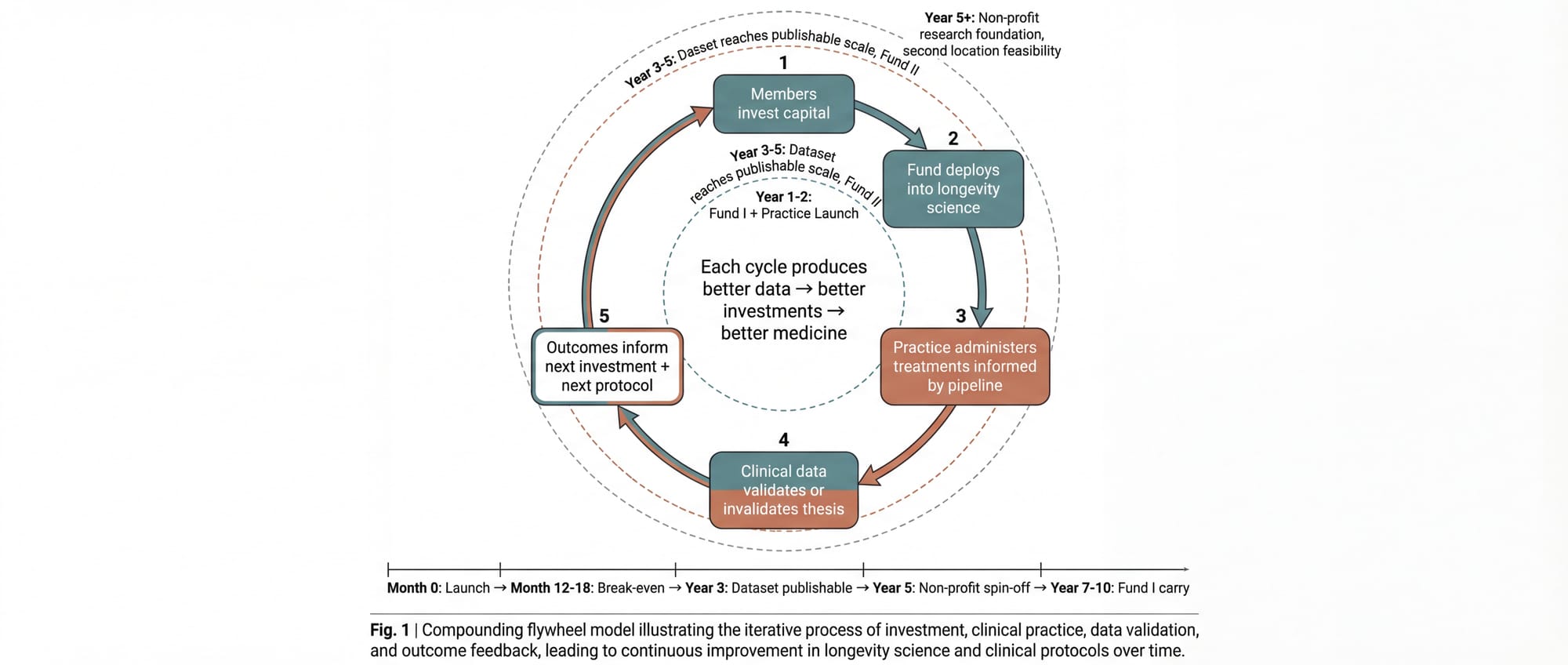

When both entities operate with a shared membership base, the following cycle emerges:

- Members invest capital into longevity companies through the fund, gaining exposure to the sector's financial upside.

- The fund deploys capital across the development spectrum (concept through Series B), with diligence informed by the clinical practice's real-world data on what interventions produce measurable outcomes.

- The practice administers treatments to its members, informed by the fund's knowledge of what's in the pipeline: which compounds are in Phase II trials, which diagnostics show breakthrough accuracy, which delivery mechanisms are gaining regulatory traction.

- Clinical data validates or invalidates the investment thesis. If a portfolio company's senolytic compound doesn't move the biomarkers in the practice's patient population, that's a signal. If it does, that's conviction.

- Outcomes inform both the next investment decisions and the next treatment protocols. The fund gets smarter. The practice gets better. The members receive both financial returns and personal health benefits that improve with each iteration.

The cycle compounds. Each iteration produces better data, which produces better investments, which produce better medicine.

VI. Where Selfish Becomes Selfless

The architecture described above is, at its core, a luxury product for wealthy people. 100 members at $100,000 to $150,000+ per year. Minimum $1 million for fund participation. Exclusive by design.

That exclusivity is precisely what makes the non-profit conversion possible.

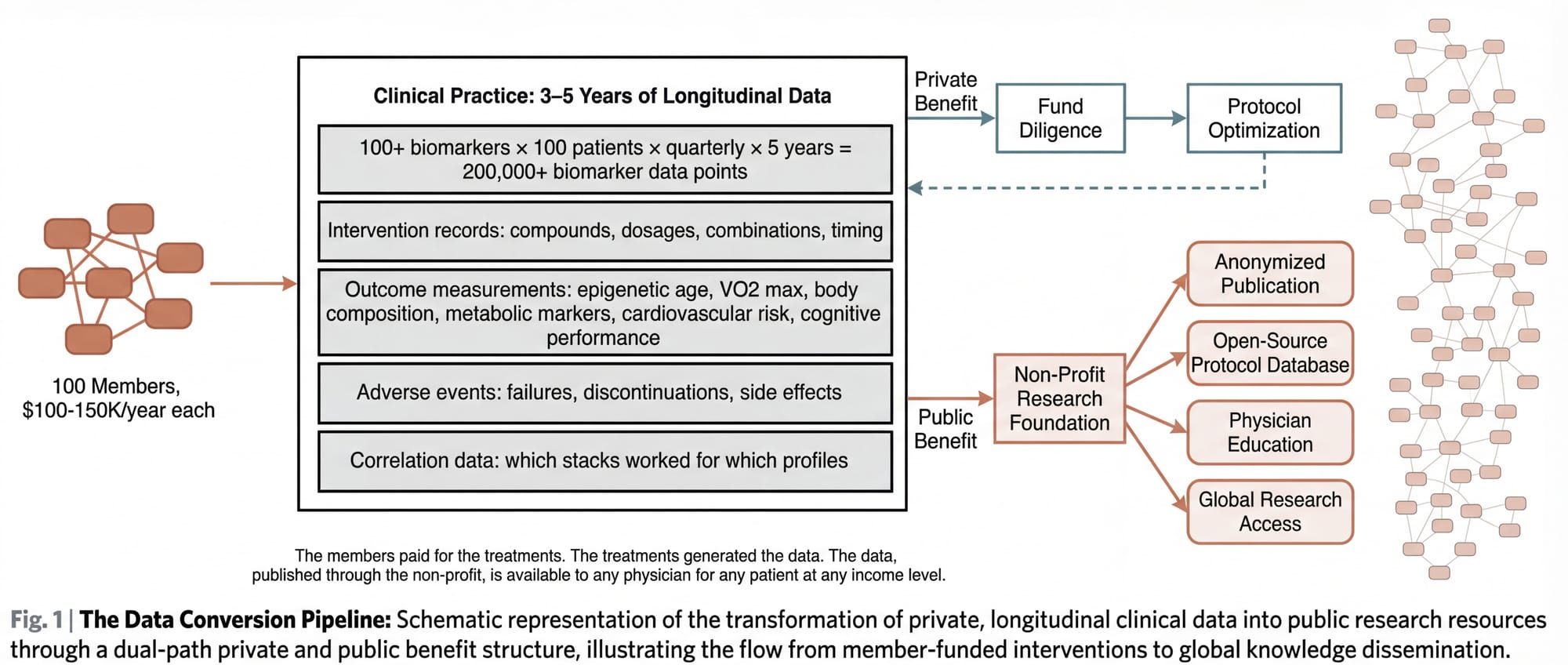

A clinical practice serving 100 high-compliance, high-monitoring patients over three to five years generates a dataset that functions, for practical purposes, as a longitudinal clinical study. Not a randomized controlled trial (the patients are not randomized, and the interventions are personalized), but a real-world evidence dataset of significant depth and specificity.

Consider what this data contains:

- Baseline and longitudinal biomarker panels (100+ markers, measured quarterly) for 100 patients across 3 to 5 years

- Detailed intervention records: which compounds, which dosages, which combinations, which timing

- Outcome measurements: biological age via epigenetic clocks, VO2 max, body composition, metabolic markers, cardiovascular risk, cognitive performance, sleep architecture, inflammatory markers

- Adverse event records: what didn't work, what caused problems, what was discontinued and why

- Correlation data: which intervention combinations produced the best outcomes for which patient profiles

- Regenerative medicine outcomes: longitudinal tracking of stem cell, exosome, and PRP treatments with pre- and post-intervention biomarker data

This is the dataset that longevity research desperately needs and currently doesn't have. Academic institutions can't generate it because they can't afford to run 100-patient, 5-year, multi-intervention longitudinal studies without massive grant funding. That grant funding doesn't exist for combinatorial protocol studies because the FDA doesn't have a framework for approving combinatorial protocols, so the NIH doesn't prioritize funding them.

The convergence model generates this data as a byproduct. It doesn't need a grant. It doesn't need FDA approval. The data exists because the members are paying for it: paying for the treatments that generate the data, paying for the monitoring that records it, paying for the physician relationships that interpret it.

The non-profit conversion works like this: Once the dataset reaches sufficient scale and duration (likely Year 3 to 5), the practice establishes or partners with a non-profit research foundation. The foundation's mandate: to anonymize, structure, and publish the clinical outcomes data. To make the protocols, dosing schedules, combination stacks, failure reports, and longitudinal outcomes available to any physician, researcher, or institution in the world.

The non-profit doesn't replace the practice. It doesn't compete with it. It takes the informational exhaust of the practice (the data that members have already paid to generate) and converts it into a public good.

The wealthy members funded their own longevity optimization. The optimization generated data. The data, published through a non-profit, informs protocols that any physician can implement for any patient at any income level.

This is the thesis. Not that wealthy people should fund longevity research out of altruism (they won't, at least not at the scale required), but that a structure can be designed where their self-interested investment in their own healthspan produces, as a structural byproduct, the research and data necessary to extend healthspan for everyone.

VII. Why This Hasn't Been Built

If the thesis is sound, the obvious question is: why doesn't this exist yet?

The answer is structural complexity. Every barrier is solvable, but they must be solved simultaneously.

Legal complexity. California's Corporate Practice of Medicine doctrine (among the strictest in the nation) prohibits non-physicians from owning or controlling a medical practice. The fund cannot own the clinic. The clinic cannot be a subsidiary of the fund. They must be legally, financially, and operationally independent entities connected only by shared founding leadership and a Management Services Agreement. SB 351 further tightened the rules in 2026. AB 1415 added mandatory 90-day advance reporting for material MSO-PC transactions. Building a compliant structure requires a healthcare attorney with CPOM/MSO expertise, a securities attorney with fund formation experience, and a tax attorney who understands multi-entity California structures. Simultaneously.

Regulatory duality. The fund is regulated by the SEC and the California DFPI. The practice is regulated by the California Medical Board, the Department of Public Health, the DEA, CLIA, and HIPAA. Operating at the intersection of securities regulation and healthcare regulation requires parallel compliance infrastructure that doubles the legal and administrative burden.

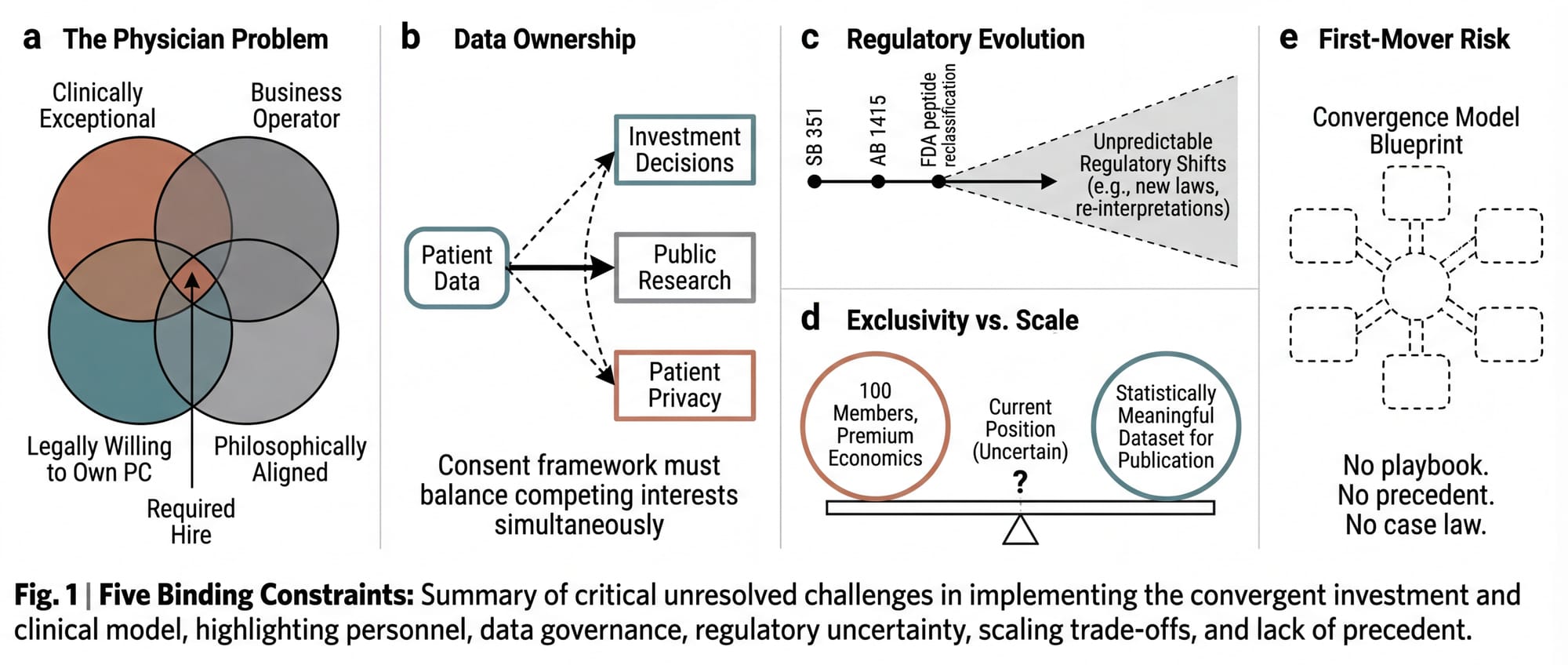

Talent scarcity. The model requires a physician-owner who is simultaneously an exceptional clinician in longevity medicine, a business operator comfortable with the PC/MSO structure, and a partner aligned with the convergence thesis. This person must also be willing to put their medical license on the line by owning the PC and bearing personal professional liability. This is a small intersection on a Venn diagram.

Dual expertise. Fund management and clinical practice management are entirely different disciplines with different skills, networks, daily rhythms, and regulatory knowledge. A founding team that can operate credibly in both worlds (commanding respect in a biotech partner meeting and a physician recruiting conversation on the same day) is rare.

Capital patience. The model requires $5 to $8 million in startup capital for the clinical operation and MSO infrastructure, independent of the fund raise. The practice doesn't reach break-even until Month 12 to 18 (substantially faster at the $100K+ membership price point than at lower tiers). The fund generates meaningful carried interest only in Years 7 to 10. The clinical data doesn't reach publishable scale until Year 3 to 5. This requires patient capital from investors who understand that the value compounds over years, not quarters.

These barriers are real and non-trivial. They explain why the convergence model exists as a thesis rather than an operating entity. But they are also, every one of them, solvable with the right combination of legal architecture, physician partnership, founding capital, and the willingness to absorb regulatory complexity as a feature rather than a bug.

VIII. The Open Questions

Intellectual honesty requires acknowledging what is unresolved.

1. The physician problem remains the binding constraint. The entire clinical operation depends on finding a physician who is clinically exceptional, legally willing to own the PC, operationally sophisticated, and philosophically aligned. California's CPOM doctrine makes this person the single point of failure. If they leave, the PC must be restructured. If they disagree with the founding vision, they have legal authority to override it on all clinical matters. The right physician makes the model work. The absence of one makes it impossible.

2. Data ownership is ethically complex. If the clinical data powers both investment returns and public research, the consent framework must be extraordinarily clear. Patients must understand that their anonymized data may inform investment decisions and may eventually be published through a non-profit. The ethical framework for this hybrid use of clinical data is novel. It requires careful design by bioethicists and healthcare attorneys working in concert.

3. Regulatory evolution is uncertain. The FDA is actively reclassifying peptides, tightening compounding regulations, and evolving its stance on off-label prescribing. SB 351 and AB 1415 are new laws with untested enforcement patterns. The model must be built to absorb regulatory change rather than depending on the current regulatory environment persisting indefinitely.

4. The exclusivity-scale tension is real. The model's economics depend on exclusivity: limited membership, premium pricing, high-touch physician access. But the altruistic thesis depends on scale: enough patients, enough data points, enough longitudinal depth to produce statistically meaningful findings. 100 members for 5 years may be sufficient. Or it may not. The minimum viable dataset for publishable longevity research is itself an open question.

5. First-mover risk is non-trivial. No one has built this. The regulatory playbook doesn't exist. The compliance precedents don't exist. The case law doesn't exist. The first entity to build the convergence model will be the test case for every regulator, attorney, and competitor who follows.

IX. What Comes Next

The forces described in this paper are not slowing down. Private capital flowing into longevity is accelerating. The cultural mainstreaming of health optimization (driven by GLP-1 agonists, public self-experimentation, the podcast ecosystem) is accelerating. The scientific breakthroughs are accelerating. The regulatory tension between innovation and approval is intensifying.

The integrated fund-and-practice model will likely be built. The evidence for the structural demand is strong and compounding. The question is whether it will be built intentionally (with the architectural foresight to include non-profit data conversion, publication mandates, and a bridge between Tier Two and Tier One) or whether it will emerge optimized purely for profit, without the structure that converts private luxury into public utility.

The concept described in this paper was fully developed: entity structures, legal frameworks, financial projections, clinical operations plans, regulatory compliance roadmaps, implementation timelines. It was designed for California, the strictest CPOM jurisdiction in the country, because if it works there, it works anywhere. It was designed for Marin County, because the Bay Area concentrates the UHNW population, the biotech ecosystem, the venture capital infrastructure, and the cultural orientation toward health optimization in a single geography.

It has not yet been built. The founding team composition and capital alignment required to launch both entities simultaneously have not yet converged in a single effort

But the thesis remains. The market remains. The gap remains. And the structural proof that private self-interest in longevity can be converted, systematically and at scale, into public benefit remains available to anyone with the clinical expertise, the investment acumen, and the architectural patience to build it.

This concept was developed between 2024 and 2026. The full architecture was designed but not executed. The thesis, the market, and the structural gap described in this paper remain as of the date of publication.

If these ideas are of interest (as an investor, a physician, a researcher, or a builder) the conversation is open.